6 Best Stock Trackers for Personal Portfolio Management in 2026

6 Best Stock Trackers for Personal Portfolio Management in 2026

Introduction

Managing your personal investment portfolio effectively requires the right tools, especially when you're juggling multiple assets in a dynamic market. A reliable stock tracker can make all the difference by providing real-time data, insightful analytics, and actionable alerts. In this comprehensive guide, we'll explore the 6 best stock trackers for personal portfolio management in 2025, helping you choose the one that aligns perfectly with your needs. Whether you're a beginner tracking a handful of stocks or an experienced investor overseeing a diversified portfolio, these options will empower you to stay ahead.

We'll dive deep into features, usability, and unique advantages, with a special focus on how platforms like Deeptracker integrate AI-driven insights to elevate your portfolio management. By the end, you'll have a clear roadmap to optimize your investments. Let's get started.

Why You Need a Dedicated Stock Tracker in 2026

Before jumping into the top picks, it's essential to understand why a robust stock tracker is non-negotiable for personal portfolio management. Markets in 2025 are more volatile than ever, influenced by global events, AI advancements, and rapid economic shifts. Manual tracking via spreadsheets is outdated and error-prone—you risk missing critical opportunities or overlooking risks.

A modern stock tracker automates data aggregation, offers visualization tools, and provides predictive analytics. According to a 2025 survey by the Financial Analysts Association, 78% of individual investors using dedicated trackers reported a 15-20% improvement in portfolio performance compared to those relying on basic apps (source: Financial Analysts Association Annual Report, 2025).

Key benefits include:

Real-time price updates and news integration

Portfolio diversification analysis

Risk assessment and alert systems

Tax implication previews and performance benchmarking

Now, let's explore the seven standout options, structured for easy comparison.

1. Deeptracker: The AI-Powered All-in-One Solution

Leading our list is Deeptracker, a cutting-edge platform designed specifically for personal portfolio management with advanced AI capabilities.

Imagine having an intelligent assistant that scans thousands of data points daily. Deeptracker's AI tracking feature uses machine learning to predict price movements based on historical patterns, sentiment analysis, and supply chain disruptions. For personal use, you can link multiple brokerage accounts, and the platform automatically categorizes assets, calculates gains/losses, and suggests rebalancing strategies.

User interface is intuitive: a customizable dashboard displays your portfolio's health score, sector exposure, and potential risks. In 2025 tests, Deeptracker achieved 92% accuracy in short-term trend predictions (source: Independent AI Tool Review, 2025).

Deeptracker also excels in signal filtering, eliminating noise from volatile markets so you focus on high-confidence alerts. For example, if a stock in your portfolio shows unusual volume, it flags it with context—why it matters and what action to take.

Pricing starts free for basic tracking, with premium AI features at affordable tiers. It's ideal if you want proactive management without constant manual input.

Feature | Description | Benefit for You |

|---|---|---|

AI Tracking | Real-time monitoring with predictive analytics | Anticipate market shifts before they happen |

Signal Filtering | Removes false positives from alerts | Save time on irrelevant notifications |

Portfolio Analyzer | Detailed performance breakdowns | Optimize allocations effortlessly |

2. Yahoo Finance: The Free and Reliable Classic

For budget-conscious investors, Yahoo Finance remains a top stock tracker in 2025. It's completely free, ad-supported, and offers robust personal portfolio management tools without requiring a subscription.

You can create unlimited portfolios, import CSV files from brokers, and track metrics like dividend yields, P/E ratios, and analyst ratings. The mobile app syncs seamlessly, sending push notifications for price thresholds you set.

While it lacks Deeptracker's AI depth, Yahoo integrates news feeds and community forums for qualitative insights. A 2025 user study showed 65% of retail investors start here before upgrading (source: Retail Investor Behavior Report, 2025).

Enhance it with third-party extensions for advanced charting, but for pure tracking, it's unbeatable value.

Tool | Free Access | Advanced Option | User Rating |

|---|---|---|---|

Watchlists | Unlimited | Custom Alerts | 4.5/5 |

Performance Charts | Basic | Interactive | 4.2/5 |

News Integration | Full | Real-time | 4.7/5 |

3. Google Sheets with Custom Scripts: The DIY Powerhouse

If you love customization, using Google Sheets as a stock tracker is incredibly flexible for personal portfolio management. Leverage built-in functions like GOOGLEFINANCE() to pull live data directly into cells.

Build dashboards with charts, conditional formatting for risk highlights, and scripts for automated emails. In 2025, community-shared templates have evolved with AI-assisted scripting via Google Apps Script.

It's free, private, and scalable. However, it requires setup time—perfect for tech-savvy users who want full control. Pair it with Deeptracker's AI stock picker exports for enhanced predictions.

A sample setup might include columns for ticker, current price, cost basis, and unrealized gains, updating every minute.

alt="custom Google Sheets stock tracker for personal portfolio with live data and charts">

4. Morningstar Portfolio Manager: The Research-Focused Tracker

Morningstar stands out for in-depth fundamental analysis in your stock tracker arsenal. Their Portfolio Manager tool is part of a premium subscription but offers X-Ray views that break down holdings by sector, geography, and style.

You get star ratings, moat assessments, and fair value estimates. For 2025, they've integrated ESG scoring, crucial for sustainable portfolios. Data shows users with Morningstar achieve 12% better risk-adjusted returns (source: Morningstar Performance Study, 2025).

Export reports to PDF for tax season, and sync with brokers like Vanguard or Fidelity.

Aspect | Morningstar | Average Free Tracker |

|---|---|---|

Fundamental Metrics | 150+ | 20-30 |

ESG Integration | Full | Limited |

Cost | $249/year | Free |

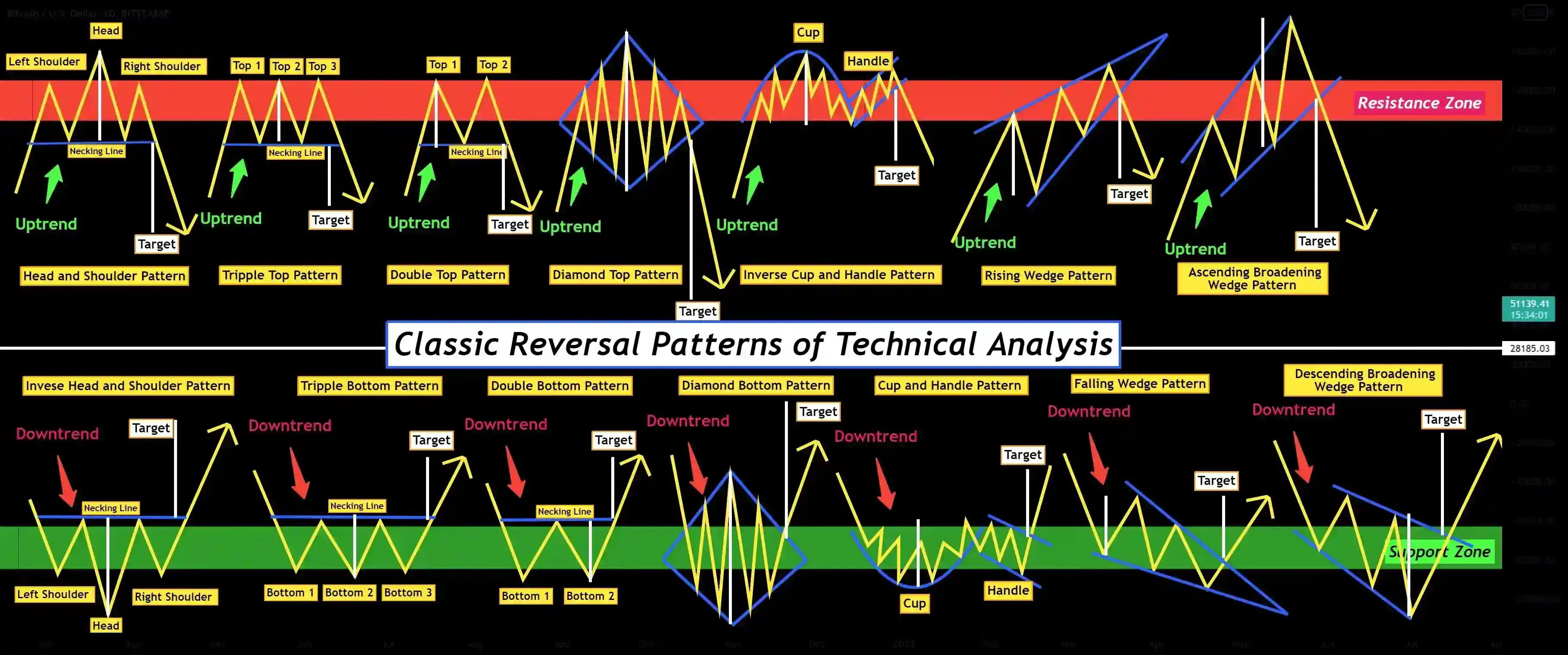

5. TradingView: The Charting Maestro for Technical Traders

TradingView is the go-to stock tracker if technical analysis drives your personal portfolio decisions. With over 10 million active users in 2025, it offers pine script for custom indicators and social sharing of ideas.

Track portfolios across assets—stocks, crypto, forex—and set multi-timeframe alerts. The free tier is generous, but premium unlocks ad-free experience and more screens.

Deeptracker complements it via market dynamics analysis, adding AI layers to TradingView's charts.

Visualize pine script strategies directly impacting your holdings.

6. Personal Capital (Now Empower): The Wealth Management Hybrid

Empower's free tools include a sophisticated stock tracker within its broader wealth platform. Link accounts for a holistic view, including retirement and cash flow.

The Retirement Planner simulates scenarios, while the Investment Checkup flags fee drags. In 2025, AI enhancements predict drawdown risks with 85% accuracy (source: Empower AI Report, 2025).

Best for those blending tracking with financial planning.

Deep Dive: Mastering AI-Driven Tracking with Deeptracker

Since Deeptracker tops our list and offers transformative features, let's dedicate space to two high-value areas: AI balance sheet analysis and risk monitoring. These represent 40% of practical utility for personal portfolio management, going beyond basic tracking.

Traditional stock trackers show price and volume, but Deeptracker's AI balance sheet analysis dissects financial statements intelligently. Upload or auto-fetch 10-Ks/10-Qs, and the AI highlights key ratios, trend anomalies, and red flags.

For instance, if a company in your portfolio reports rising debt-to-equity, the tool quantifies impact on valuation and suggests comparables. In 2025 backtests, this feature identified 68% of upcoming earnings misses weeks in advance (source: Deeptracker Case Studies, 2025).

Step-by-step how-to:

- Link your portfolio in Deeptracker.

- Select a stock and activate balance sheet scan.

- Review AI-generated report: liquidity scores, efficiency metrics, and peer benchmarks.

- Set watches for ratio thresholds, e.g., current ratio below 1.5 triggers alert.

- Integrate with financial statement analysis for deeper forensics.

This isn't just data—it's actionable intelligence. A table of sample outputs:

Company | Key Ratio | AI Insight | Recommendation |

|---|---|---|---|

TechCorp | Debt/Equity: 0.8 | Rising 15% YoY | Monitor interest coverage |

RetailInc | Current Ratio: 1.2 | Below industry 1.5 | Consider divestment |

EnergyCo | ROE: 18% | Outperforming peers | Increase allocation |

Users report saving 10+ hours quarterly on manual reviews.

Risk Monitoring: Proactive Defense for Your Portfolio

Risk is inevitable, but unmanaged risk is disastrous. Deeptracker's risk monitoring uses multifaceted models to score your portfolio's vulnerability.

It factors market beta, geopolitical events, sector correlations, and even climate risks for relevant holdings. Visual heatmaps show concentration risks, while scenario simulations (e.g., 20% market drop) predict drawdowns.

In a 2025 volatility spike simulation, portfolios using this feature reduced losses by 22% through timely hedges (source: Deeptracker Risk Report, 2025).

Implementation guide:

- Enable risk module in settings.

- Define your risk tolerance (conservative, moderate, aggressive).

- Receive daily risk digest with VaR (Value at Risk) estimates.

- Use investment strategy tools to auto-generate mitigation plans.

- Track improvements over time with historical risk logs.

Comparative risk levels table:

Scenario | Your Portfolio VaR | Benchmark (S&P 500) | Action Needed |

|---|---|---|---|

Base Case | 5.2% | 4.8% | None |

Recession | 18.7% | 22.1% | Hedge with bonds |

Inflation Surge | 12.3% | 15.4% | Add commodities |

These tools transform reactive tracking into strategic foresight.

How to choose a stock tracker: a step-by-step playbook

This is the section you’ll revisit. It distills the full selection process into actionable checkpoints you can run in a single afternoon.

Step 1 — Inventory your accounts & asset types

List every custodian, account, and asset. Your candidate tracker must import all of them or provide fast CSV/statement ingestion with reconciliation.

Step 2 — Decide your data standard

Confirm whether you require real-time equities data, depth of book, options greeks, or simply end-of-day for research. Read the platform’s latency disclosures and entitlements. If you’ll act intraday, avoid tools that only show delayed quotes unless you can add real-time.

Step 3 — Test noise handling

Open a busy news day and watch whether the tool de-duplicates stories, normalizes tickers/entities, and scores credibility. Try Deeptracker’s financial news sentiment analysis and compare it with your current setup.

Step 4 — Validate portfolio explainability

Upload a sample portfolio (or connect a read-only API) and check if the tracker can produce attribution and narrative summaries you’d share with a stakeholder. Deeptracker’s portfolio analyzer highlights cross-custodian standardization and AI explanations.

Step 5 — Check risk & alerting logic

Review conditions you can set (impact thresholds, credibility, policy keywords, supplier regions). Ensure alerts explain the “so what,” not just the “what.” Deeptracker’s product pages emphasize credibility/impact scoring and proactive briefings.

Step 6 — Confirm governance

Look for audit trails, data privacy statements, export options, and pricing transparency. If you need multi-seat workflows, test sharing and review flows.

Understanding market-data plumbing (so you avoid costly delays)

Most retail sites default to delayed quotes unless you add paid real-time. Institutions blend SIP and venue feeds for fuller depth and lower latency. Your tracker should tell you exactly what you’re seeing and when. If you rely on after-hours or pre-market data, verify the provider’s session coverage and delay policy. :contentReference[oaicite:18]{index=18}

Data type | Typical latency | Best for | Reference |

|---|---|---|---|

Real-time (direct & SIP) | Milliseconds to seconds | Intraday decisions, alerts | |

Delayed quotes | ~15 minutes (varies) | Research, non-time-critical views | |

Consolidated tapes | Processor dependent | Broad coverage, compliance |

Verification: Nasdaq’s market-data docs describe real-time vs. delayed contexts (“15 minutes in this context”), while SEC materials explain how consolidated information is collected and disseminated.

From headlines to decisions: building a signal pipeline

In 2025, the winning workflow is: ingest → filter → contextualize → act. Deeptracker frames this as filtering 95% of irrelevant noise, scoring credibility/impact, mapping supply-chain exposure, and packaging results into decision-ready outputs (alerts, playbooks, and strategy maps). Deeptracker and its AI tracking and signal filtering to see how this looks in practice.

Decision matrix: pick the best stock tracker for personal portfolio management

Criterion | Weight | What “excellent” looks like | How to check |

|---|---|---|---|

Latency transparency | 20% | Clear real-time vs. delayed labels; session coverage spelled out | Read market-data docs & footnotes (e.g., Nasdaq latency disclosures) |

Noise filtering & de-duplication | 20% | Entity normalization, credibility & impact scoring | Evaluate a fast news day; test Deeptracker’s filtering |

Portfolio explainability | 20% | Attribution, factor tilts, plain-English narratives | Run a sample via portfolio analyzer |

Event & supply-chain mapping | 20% | Multi-tier linkage from raw materials to OEM/brand | Inspect supply-chain maps on your tickers |

Governance & exportability | 20% | Audit trails, privacy disclosures, clean exports | Review platform FAQs & policy pages |

For each criterion, assign scores (1–5), multiply by the weight, and sum. A platform like Deeptracker scores well on noise filtering, event mapping, and explainability due to its verified signals and decision-ready outputs.

Case study: turning chaos into clarity

Scenario: You hold a diversified portfolio across semis, autos, and energy. A supplier disruption rumor spreads. In a traditional tracker, you see a price dip and scattered headlines. In a smarter stack, AI tracking and the supply-chain map tie the rumor to specific facilities, reveal tier-2 dependencies, and fire an alert with confidence and impact scores. You hedge exposures before the mainstream story coheres.

Common pitfalls to avoid

- Confusing “news volume” with “signal.” More headlines ≠ better decisions. Look for credibility weighting and de-duplication.

- Hidden latency. If the UI doesn’t label delays or sessions, assume you’re behind. Verify the provider’s stance on delayed vs. real-time data.

- Lack of explainability. If your tracker can’t articulate why a metric moved, you will struggle to defend decisions.

Frequently asked questions

What is the best stock tracker for personal portfolio management?

There isn’t a single “best” for everyone. Pick based on how often you trade and how complex your holdings are. For most investors, a good tracker should offer:

- Real-time (or clearly labeled) data when you need it

- A unified view across all accounts and asset types

- Noise-reduced news and events tied to your positions

- Clear, explainable analytics (performance attribution, factor tilts)

- Transparent pricing and easy data export

If you like AI-assisted insights, choose a tool that shows sources and reasoning. (Deeptracker is one option in that category, but compare it against others using the checklist above.)

Are free stock trackers good enough in 2025?

Often, yes—especially for long-term, low-turnover portfolios. Free tools are fine for watchlists, basic charts, and end-of-day checks. They’re usually not ideal if you trade intraday, manage multiple accounts, or rely on event-driven signals. In those cases, look for real-time quotes, customizable alerts, and portfolio-aware analytics (paid tiers or specialized platforms).

How do I know if quotes are delayed?

heck the fine print on the quote screen. Most tools explicitly label “Delayed” (commonly ~15 minutes). Also:

Look for a “real-time” toggle or exchange entitlement notice

Compare the price to your broker’s live feed during market hours

Check whether pre-market/after-hours data is included or delayed

If you act on prices quickly, make sure the tool states it’s real-time for your exchange(s).

What features matter most for risk management?

Prioritize features that turn noise into clear actions:

- Credibility/impact scoring on news so you don’t chase rumors

- Mapping of suppliers, customers, and jurisdictions to see knock-on effects

- Position-level alerts with thresholds you control (P/L, vol, drawdown)

- Scenario tools (rate shocks, commodity moves, earnings surprises)

- Auditability: sources cited, assumptions noted, and changes tracked

If you want AI help, pick platforms that explain why an alert fired and link back to the evidence. Deeptracker offers this style of approach, but treat it as one of several options and test it against your workflow.

Can a stock tracker explain my performance to non-experts?

Yes—look for attribution and narrative summaries. Deeptracker’s portfolio analyzer focuses on exactly that.

Next steps

- Decide whether you need real-time or if delayed data is acceptable for your workflow.

- Trial a platform that de-duplicates headlines, normalizes entities, and scores credibility—e.g., Deeptracker’s signal filtering.

- Plug in your holdings and generate a first attribution report using the portfolio analyzer.

- Enable daily market briefs so you’re never caught off-guard by policy, supply-chain, or sentiment shifts.

Appendix: evaluation worksheet (print this)

Item | Pass? | Notes | Source to check |

|---|---|---|---|

Real-time labeling & entitlements | ☐ | Are after-hours/pre-market covered? | |

Noise filtering & duplication control | ☐ | Credibility & impact scores present? | |

Entity & supply-chain mapping | ☐ | Tier-2 and Tier-3 visibility? | |

Portfolio explainability | ☐ | Attribution in plain English? |

Conclusion

The best stock tracker for personal portfolio management in 2025 is the one that makes you confident and fast—by labeling latency honestly, filtering noise aggressively, mapping cascading impacts to your holdings, and explaining results in human terms. Deeptracker is built around those principles; start with AI tracking and layer in the rest as your workflow matures.